Our well-diversified, high-quality asset portfolio focused on the informal segments of the society, combined with our fast expanding liabilities franchise, enables us to seamlessly navigate economic cycles. We are redefining convenience and simplicity with our ‘digital first’ approach – strengthening our relationship with existing customers while bringing new ones to the fold. With the buildout phase now behind us, we are well positioned to continue creating sustainable value for our stakeholders.

Our strong growth and profitability amid a challenging environment reflects our robust fundamentals. With an unwavering focus on maintaining the highest asset quality and using technology as a key enabler, we are reinventing the way banking is delivered and experienced. Anchored to our core values and steadfast commitment to adhering to the highest standards of governance and risk management, we have laid a strong foundation of trust, on which we aspire to build an inclusive future.

Customer First

Pride for performance

Fair and transparent

Respect for people

Ownership

Leveraging existing network for deepening penetration

Strengthen liability franchise & increase retail base

Leverage data analytics to drive operational efficiency

Focus on digital products & technology

Continue to diversify product offerings

Focus on non-interest income sources

India has a large economically active but unbanked and underbanked population segment. According to industry estimates, assets under management at Small Finance Banks (SFBs) are likely

to grow at a CAGR of 25% over 2019-25 to J1,833 billion; deposits are likely to grow at a CAGR of 60-65% to J2,272‑2,492 billion over the same period.

Source – CRISIL report

ESFB has the largest number of Banking Outlets among SFBs

ESFB is the second largest SFB in terms of AUM and total deposits

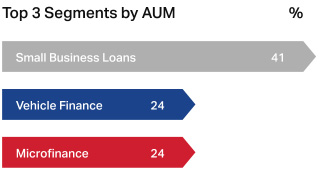

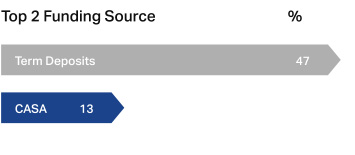

Over the years, we have strategically reduced our exposure to the microfinance segment and focused on secured lending with quality underlying collaterals. With the government’s clarion

call for building a ‘self-reliant’ India, there will be renewed focus on strengthening micro, small and medium enterprises, which are considered the backbone of the economy.

With our compressive suite of products targeted it mass and mass affluent segments, we have significantly increased our deposit. Further, we are driving inclusive banking by converting

our microfinance and asset customers to account holders, which is further expanding our penetration and increasing customer stickiness.

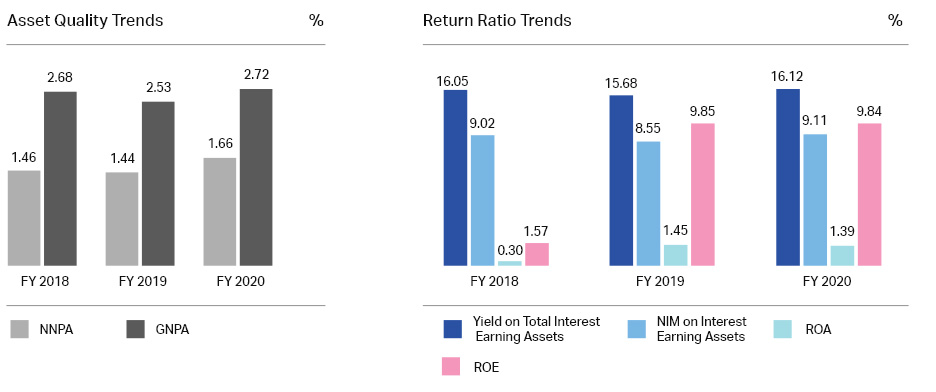

Despite a challenging environment for the banking industry as a whole, we have been able to maintain our asset quality at comfortable levels and have steadily improved our return

ratios.

Our prudent approach to lending, innovative underwriting methods and focus on corporate governance have enabled us to build adequate capital buffer to withstand external shocks. Our

Liquidity Coverage Ratio (LCR) at 133.2% also stands ahead of the minimum LCR requirement of 90%.

| Capitalisation snapshot | ESFB | Minimum Requirement |

|---|---|---|

| CRAR | 23.61% | 15% |

| CRAR – Tier I | 22.44% | 7.5% |

| CRAR – Tier II | 1.17% | – |

Stay current with our latest IR updates.